Selling your business is one of the most significant financial and emotional decisions you’ll make. It’s a complex process that requires careful planning, strategy, and execution to ensure a successful outcome. Unfortunately, many business owners make avoidable mistakes that can reduce the value of their business, delay the sale, or lead to unfavorable terms. This […]

The Western Team

Click and drag to View our Sell-Side M&A experts

-

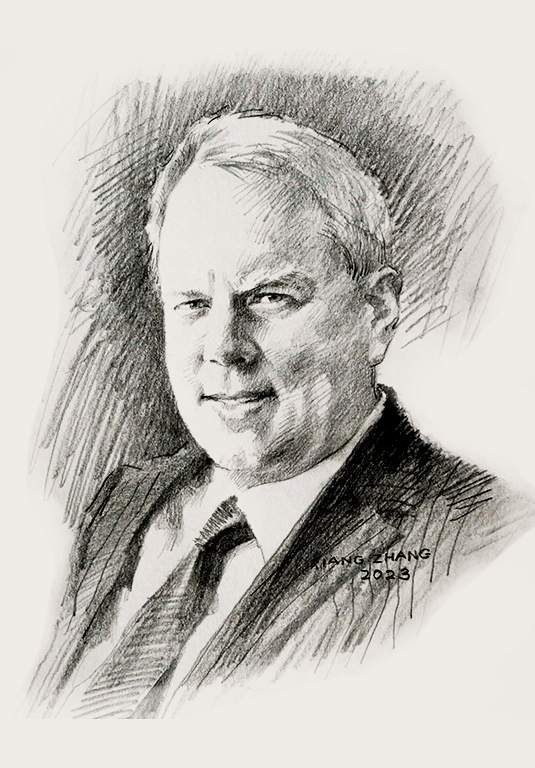

Don Woodard, Jr.

President

-

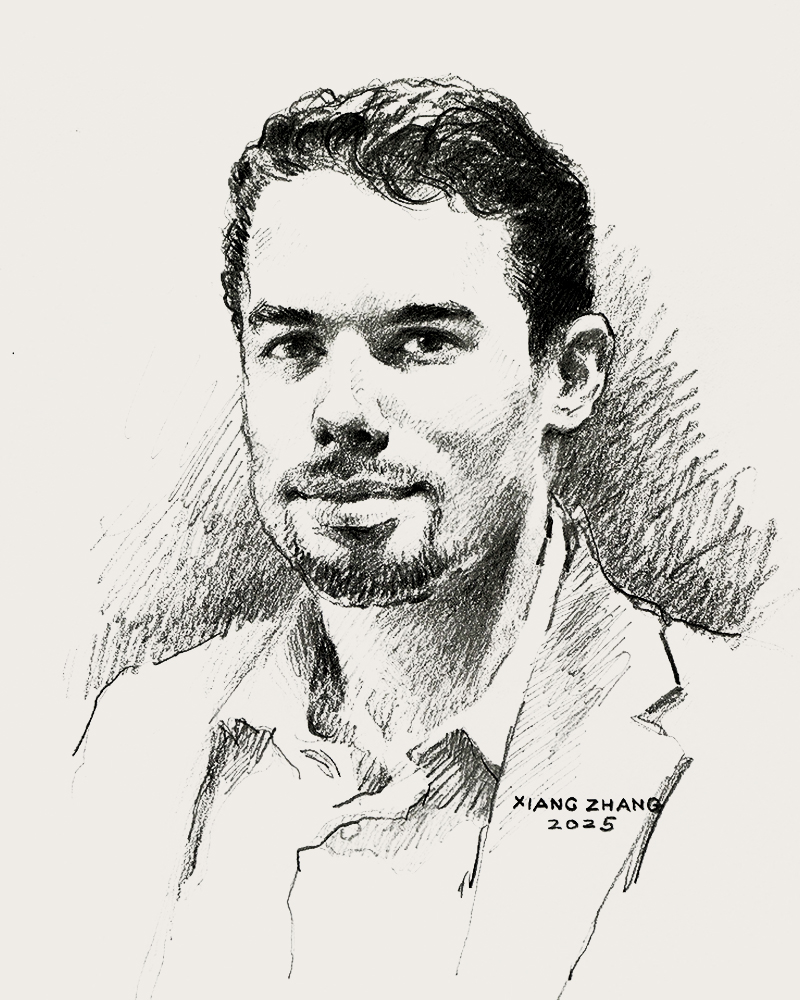

Turner Holthaus

Chief Operating Officer

-

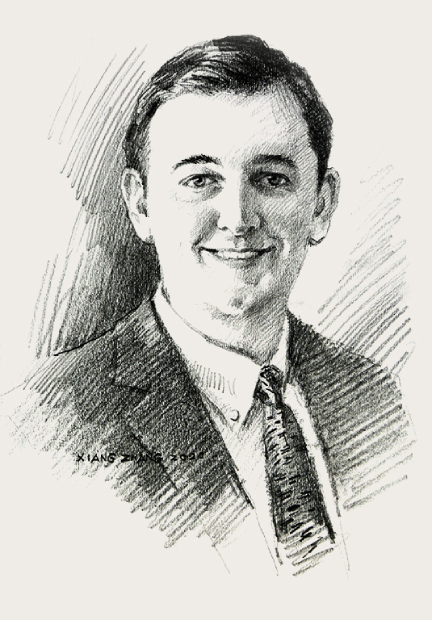

Rick Groesch

Chief Commercial Officer

-

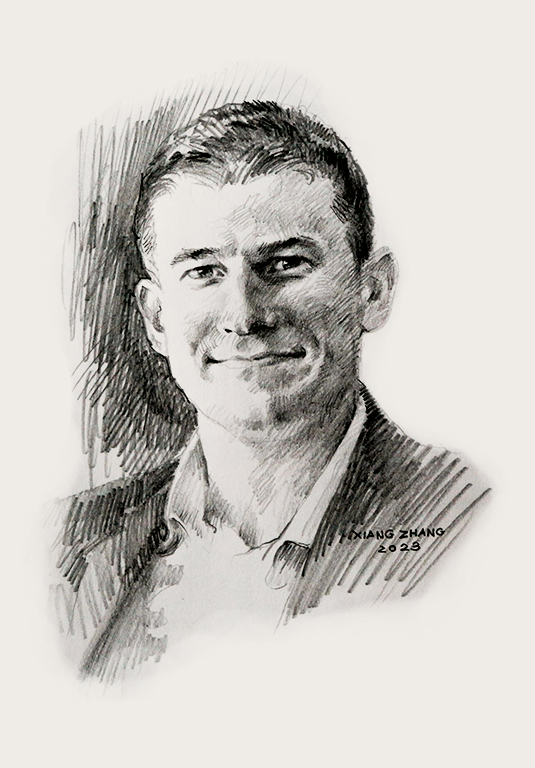

Don Woodard III

Chief Marketing Officer

-

Jack Todd

Head of Execution

-

Jerad Masse

Business Development

-

Chris Wolf

Vice President, Deal Execution

-

Bryce Jones

Deal Execution